|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

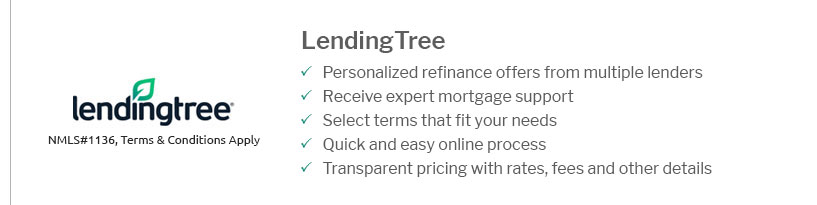

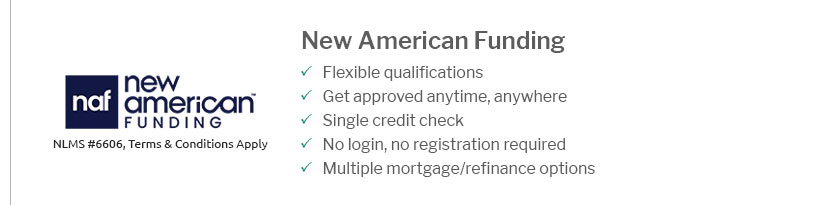

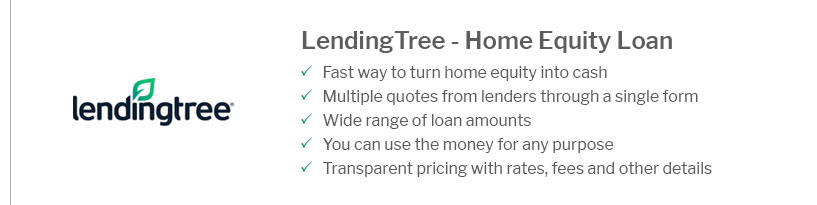

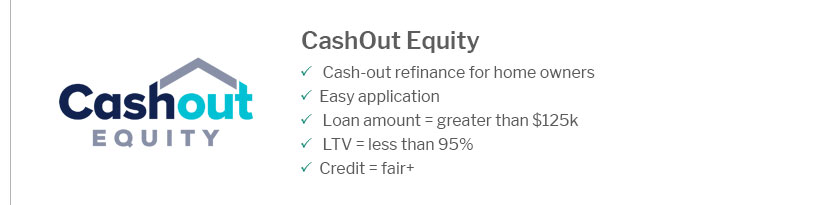

Steps to Buying a Home: A Comprehensive GuidePurchasing a home is a significant milestone and an exciting journey. Understanding the steps involved can simplify the process and help you make informed decisions. Understanding Your Financial SituationBefore embarking on the home buying journey, it is crucial to assess your financial health. Check Your Credit ScoreYour credit score plays a vital role in determining your mortgage eligibility and interest rates. Ensure your credit report is accurate and address any discrepancies. Determine Your BudgetAssess your finances to determine how much you can afford. Consider your income, expenses, and potential mortgage payments to establish a realistic budget. Getting Pre-Approved for a MortgageGetting pre-approved for a mortgage gives you a clear idea of how much you can borrow and demonstrates to sellers that you are a serious buyer. Research Lenders

Submit Your ApplicationProvide necessary documentation, such as proof of income and employment, to your chosen lender to obtain pre-approval. Finding Your Dream HomeOnce pre-approved, you can start searching for a home that meets your needs and budget. Engage a Real Estate AgentA knowledgeable real estate agent can help you navigate the market and find suitable properties. Attend Open HousesVisit open houses to explore different properties and neighborhoods, helping you refine your preferences. Making an Offer and Closing the DealAfter finding the right home, the next step is making an offer and closing the deal. Negotiate the OfferWork with your real estate agent to negotiate a fair offer with the seller. Be prepared for counteroffers and adjustments. Finalizing the Purchase

FAQs About Buying a HomeWhat is the first step in buying a home?The first step is to assess your financial situation, including your credit score and budget, to determine how much you can afford. Why is getting pre-approved important?Pre-approval helps you understand your borrowing capacity and shows sellers that you are a serious buyer, giving you a competitive edge in the market. How can I make my offer more appealing?To make your offer more appealing, consider being flexible with closing dates, offering earnest money, and ensuring your financing is solid. https://www.travelers.com/resources/home/buying-selling/how-to-buy-a-home

We've prepared a helpful list of key steps most buyers should think about. Along the way, consider that there are benefits to working with experienced ... https://www.mass.gov/guides/the-homebuying-process-in-massachusetts

What to do when you've found the home you would like to purchase - Complete your mortgage loan application - Hire an attorney - Make and accept an offer. https://www.nerdwallet.com/article/mortgages/home-buying-checklist-steps-to-buying-house

This step-by-step checklist will guide you through the process of buying a house.

|

|---|